defer capital gains tax australia

The deferral is in effect until the QOF investment is sold or exchanged or on Dec. Leaving Australia means capital gains tax can arise - CGT Event I1 - as there is a deemed disposal of investments at their market value.

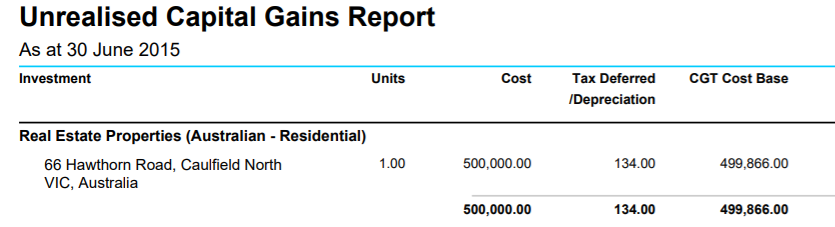

Accumulated Depreciation Simple Fund 360 Knowledge Centre

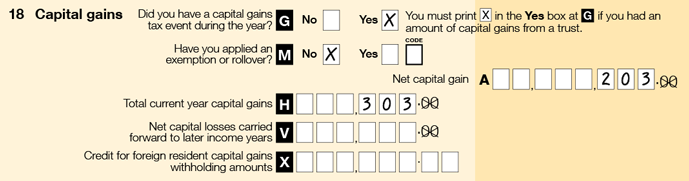

MyTax 2021 Capital gains or losses.

. The investor is then exempt from income tax for that proportion of the income distributions they have. Businesses wishing to use the small business CGT concessions can also apply for an extension in situations where they need to take a certain action within a certain. 31 2026 whichever comes first.

National 1031 Exchange Services. However the exemption may not fully apply if the. Under current law short-term capital gains are treated as ordinary income with a top tax rate of 408 370 plus 38 net investment income tax NIIT.

If the property you are selling is your main residence the gain is not subject to CGT. Check if your assets are subject to CGT exempt or pre-date CGT. Because the DST is recognized as an installment sale by IRS Section 453 the capital gains tax can be legally deferred.

Capital gains tax CGT in the context of the Australian taxation system is a tax applied to the capital gain made on the disposal of any asset with a number of specific exemptions the most. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. This is the advantage of the deferred sales trust.

Use the main residence exemption. Complete this section if a capital gains tax CGT event happened in 202021. For a gain to be deferrable it must be invested in a QOF within 180 days of the sale that resulted in the gain.

The Federal Government has made changes to Australian Capital Gains Tax for non residents that impacts Australian expats who still own a property back home. The objective of the capital gains tax CGT relief provisions is to provide temporary relief from certain capital gains that might arise as a result of complying with the. In the event that you sell anything for more than what you bought it for you will need to report this.

When you sell this asset after holding it for more than a year youll be taxed at the long-term capital gains rate of 15. For most CGT events. Understanding capital gains tax is critical when dealing with appreciated assets.

You may have made a capital gain or capital loss. If youre in the top tax bracket and sell a property like this youll be. Skip to primary navigation.

Trusts Wills and Probate for CA 408 437-7570. Deferred Gain on Sale of Home repealed in 1997 was a tax law allowing homeowners to defer recognition of capital gains from the sale of a principal residence. Any mischief is involved.

The gain is deferred until December 31 2026or to the year when the. A Tax-deferred rate will be determined for each financial year eg. How long do I need to live in a house to avoid capital gains tax.

Guide To Crypto Taxes In Australia Updated 2022

The New Victorian Windfall Gains Tax Pitcher Partners

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

Capital Gains Tax And Superannuation First Financial

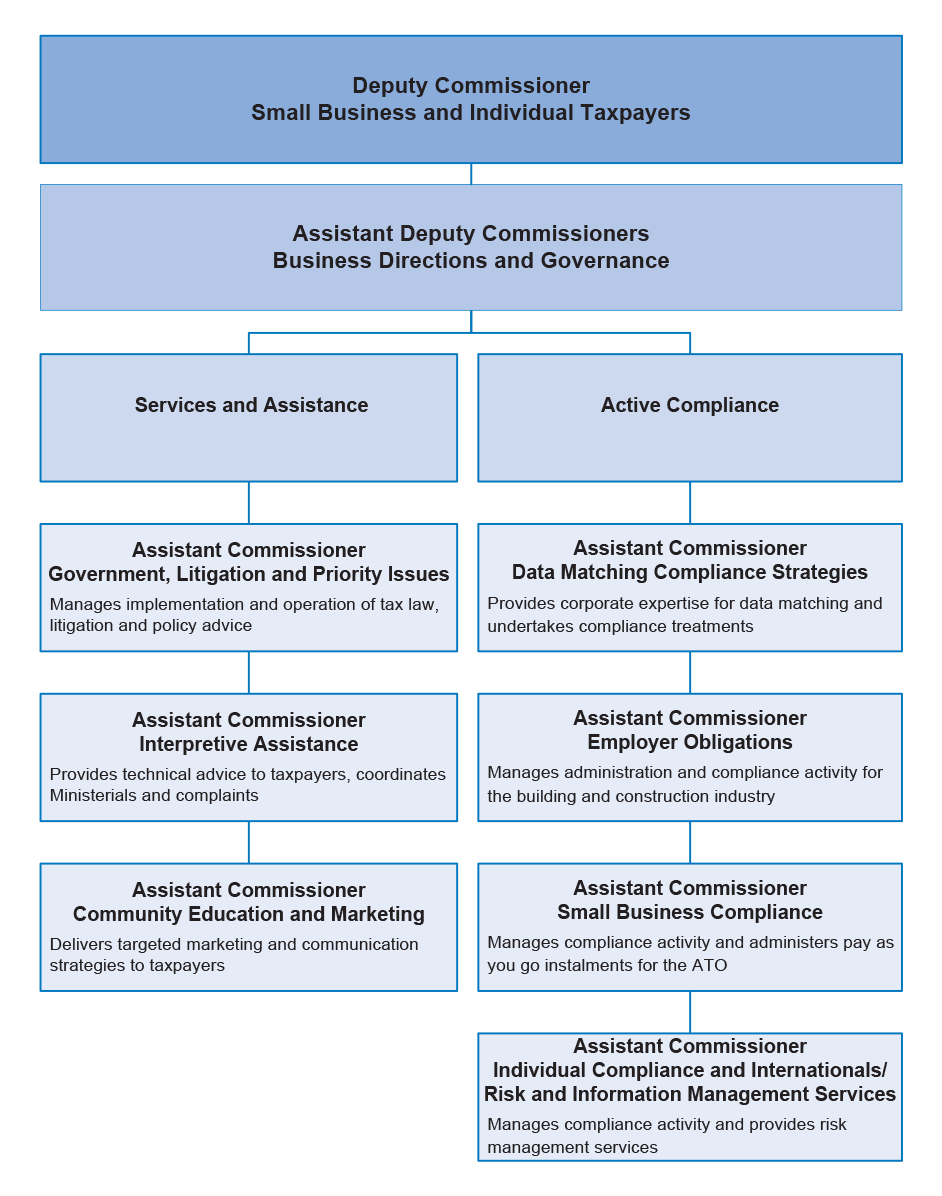

Administration Of Capital Gains Tax For Individual And Small Business Taxpayers Australian National Audit Office

Non Assessable Payments From A Trust Australian Taxation Office

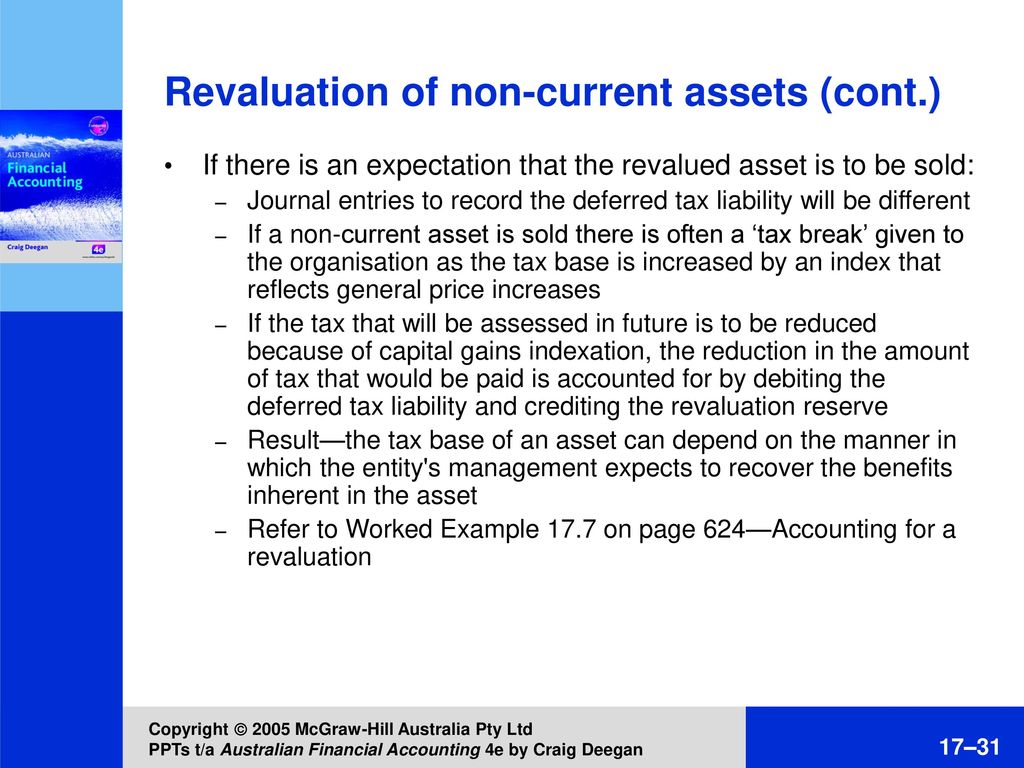

Accounting For Income Taxes Ppt Download

Make Your Business Sale Tax Effective Reduce Capital Gains

Administration Of Capital Gains Tax For Individual And Small Business Taxpayers Australian National Audit Office

6 Ways To Defer Or Pay No Capital Gains Tax On Your Stock Sales

Deferring Capital Gains Potential Benefits Russell Investments

How To Avoid Capital Gains Tax When Selling Investment Property Better Homes And Gardens

Cgt Event Time And Options Rigby Cooke Lawyers

Takeovers In Australia A Guide Ashurst

Make Tax Free Capital Gains On Australian Shares Whilst A Non Resident Expat Expat Taxes Australia

Exemptions Rollovers All Capital Gains Tax Solutions

Capital Gains Tax On Deferred Property Settlements Over 12 Months

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool